Balancing Your Payer Mix with Marketing

The biggest goal of any healthcare organization is helping people resolve major or minor health concerns so they can ultimately live healthier, happier lives. But, of course, as with any business, you also need good financial health at your practice or hospital.

As we’ve discussed before, payer mix in healthcare directly affects your bottom line and your financial well-being. Here is a quick refresher about what payer mix is, how it affects your total revenue, and some tips for balancing your payer mix with marketing strategies.

What does payer mix mean?

Payer mix is just what it sounds like: A mix of patients who pay for healthcare services with different types of payments, including self-pay, government health plans, and commercial health insurance. Commercial insurance—like the coverage employees get from their employer insurance plans—typically pays more for healthcare services than government agency plans, like Medicare and Medicaid.

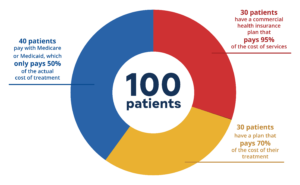

Your practice’s payer mix depends on how many patients you treat for each different type of payment/insurance. For example, let’s say the providers at your healthcare facility see an average of 100 patients per day. 30 of those patients have a commercial health insurance plan that pays 95% of the cost of services your practice bills them for; 30 patients have a plan that pays about 70% of the cost of their treatment; and the remaining 40 patients pay with Medicare or Medicaid, which only covers 50% of the actual cost of treatment.

Your practice’s payer mix depends on how many patients you treat for each different type of payment/insurance. For example, let’s say the providers at your healthcare facility see an average of 100 patients per day. 30 of those patients have a commercial health insurance plan that pays 95% of the cost of services your practice bills them for; 30 patients have a plan that pays about 70% of the cost of their treatment; and the remaining 40 patients pay with Medicare or Medicaid, which only covers 50% of the actual cost of treatment.

Providers spend the same amount of time with each patient and it costs your practice the same amount of money to treat each of those patients. However, when it comes time to collect payment from the insurance providers and government agencies, it takes even more time and effort (depending on the insurance provider) and you may not receive payment for up to 90 days or more.

As you’re probably well aware, when you have too many low-paying, difficult-to-collect payments, your bottom line suffers. When your payer mix is skewed in this direction, you may end up seeing a large volume of patients, but not collecting a large volume of money.

Understanding how much each insurance plan reimburses your healthcare organization for your most-billed services is crucial to understanding how to balance your payer mix so your revenue reflects your workload more proportionately. Once you understand which insurance plans work best with the services you offer, you can implement some marketing strategies to help you find a better balance.

Marketing tips to balance payer mix

Make sure your practice revenue isn’t heavily dependent on just one or two different types of payers. It’s better to have a handful of options you can reliably count on for the revenue you need.

Identify

Break down your revenue by identifying how much of it comes from each insurance provider. If the majority of revenue comes from Medicare patients, for example, you know you need to focus on attracting more patients with higher paying commercial insurance plans. Keep in mind that outlier patients who have received more treatment than average patients could skew this number. You may want to remove these patients from your data when going through this exercise.

Update

After identifying where your revenue comes from and where your gaps are, one way to attract more of the types of patients you want is to update your website. Focus on messaging and content that more closely fits your ideal patient base. You might put a banner on your site that says, “Now accepting new BCBS patients” to encourage people with Blue Cross and Blue Shield to schedule appointments with providers at your practice. Even if you’ve already been accepting those patients, making it seem like a new announcement can help provide an initial boost.

Attract

Another way to help balance payer mix is to attract more high-value patients to your practice. Implement marketing strategies that target your ideal patients. You can do this with paid ads that put you at the top of Google search results. So, when patients search for “top-rated orthopedist near me”, your practice appears at the top of the results page where you’re most visible.

You might also consider social media ads that attract patients where they spend most of their time online. Social media platforms, like Facebook and Instagram (Meta) allow you to target specific demographics based on interests, geographic locations, and several other criteria.

Improve Reputation

Reputation matters to new patients who begin their search for medical providers online, which is the majority of today’s healthcare consumers. Even if they are referred by another physician, new patients will still look you up online before they decide to contact you for an appointment.

Prospective patients like this already know they need your services, but they’re looking to read reviews about your providers and practice to see how you measure up. If most of your online reviews are positive, and you have a 4- or 5-star reputation, you’ll attract more high-value patients.

Use a predictive targeting tool

Take the guesswork out of knowing where to spend your marketing budget and attract more patients who have the insurance plans that help balance your payer mix. Use a predictive targeting tool to help you identify the most profitable patients.

A digital marketing platform with sophisticated analytics and data tracking can help you get in front of more of the patients you want to attract to your practice—in this case, the ones with insurance plans that reimburse the most for the services you offer.

Marketing to balance your payer mix can be a lot to digest. If you need help getting started or have questions about how to target ideal patients while still being HIPAA compliant, we’d love to hear from you.

Talk to one of SocialClimb’s healthcare marketing experts today.